Get The Right Coverage From An Experienced Independent Insurance Agency Serving Lockwood, Montana

It Just Takes A Few Clicks

Or Give Us A Call At (440) 826-3676

Independent Insurance Agency Serving Lockwood, Montana - The Allen Thomas Group

Why Choose an Independent Insurance Agency?

The Allen Thomas Group is a trusted independent insurance agency serving Lockwood and communities throughout Montana with over 20 years of experience.

Unlike captive agents who represent just one company, our licensed Montana independent agents work for you – not the insurance companies.

We partner with multiple carriers to find the perfect coverage options that protect what matters most while keeping premiums competitive.

Key benefits of working with our independent agency include:

- Access to multiple insurance carriers and policy options

- Personalized service from agents who understand Montana

- Dedicated advocates who prioritize your needs over insurance companies

- Competitive pricing through comprehensive policy comparisons

- Customized coverage that avoids one-size-fits-all solutions

Many Lockwood residents tell us they previously felt stuck with limited options from their single-company agent.

Our clients appreciate how we present multiple quotes side-by-side, explaining the differences in clear terms so they can make informed decisions.

Our insurance brokers provide honest comparisons without pushing policies that don’t fit your needs.

We build relationships based on trust and personalized service that big-name insurance companies simply can’t match.

So why wait, start your quote now!

Meet the Faces Behind Your Coverage in Lockwood, Montana

The insurance professionals at The Allen Thomas Group know Montana.

We understand the winter driving challenges, wildfire concerns, and property protection needs as you do.

Our team doesn’t just understand insurance – we understand Montana.

Our expertise includes:

- Licensed agents with an average of 5+ years of industry experience

- Specialized knowledge of Montana’s unique insurance landscape

- Ongoing education about changing regulations and coverage options

- Deep understanding of Lockwood’s specific risk factors

The same agent who helps you select your policy will be there to answer questions and assist with claims.

We build lasting relationships with our clients based on personalized service.

This personal connection makes all the difference, especially when navigating the stress of filing a claim.

Custom Family Insurance Solutions Throughout Lockwood, Montana

Montana law requires drivers to carry minimum liability coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage.

But we often recommend higher limits to properly protect your assets.

Key aspects of Montana auto insurance:

- Mandatory verification through the Montana Insurance Verification System (MTIVS)

- Law enforcement can electronically check coverage during traffic stops

- Multiple discount opportunities for safe drivers, vehicle features, and policy bundling

- Regular policy reviews to ensure coverage matches changing needs

- Personalized recommendations based on your specific driving habits and assets

Our Lockwood agents explain coverage options in plain language so you fully understand what you’re buying.

We help you make informed decisions about collision coverage, comprehensive protection, and appropriate liability limits.

Your home represents one of your largest investments and your family’s safety net.

We customize homeowners policies that protect against Montana’s specific risks, from heavy winter snowfall to summer wildfire threats.

Important facts about Montana home insurance:

- Not legally required, but typically mandated by mortgage lenders

- Average annual cost of $2,511 (36% higher than national average)

- Standard coverage includes fire, wind, hail, theft, and falling objects

- Key exclusions include flood damage, which requires separate coverage

- Local factors like wildfire risk zones significantly impact premiums

The Allen Thomas Group helps you understand standard coverages, important exclusions, and additional protection options.

We ensure you have the right coverage limits to properly protect your property and belongings.

Life insurance provides critical financial protection for your family.

Basic coverage of $14,000 is included for state employees enrolled in Montana’s medical benefits, but most families need significantly more protection.

Life insurance considerations for Montana residents:

- Term policies provide affordable protection for specific time periods

- Permanent coverage builds cash value over time

- Multiple carrier options allow for competitive rate comparisons

- Montana-specific regulations regarding beneficiaries and minor children

- Customized recommendations based on your family’s unique situation

We help Lockwood residents navigate various life insurance options to find the coverage that best fits their protection needs and budget constraints.

Montana business owners face unique insurance challenges.

Workers’ compensation insurance is legally required for all employers with one or more employees, protecting both your business and your team from work-related injuries and illnesses.

Essential business insurance coverages:

- Workers’ compensation (mandatory for Montana employers)

- Commercial auto liability (minimum $25,000/$50,000/$20,000)

- General liability (often required by commercial leases)

- Professional liability for service providers

- Cyber liability for businesses handling sensitive data

- Industry-specific protection for contractors, manufacturers, and technology companies

The Allen Thomas Group can design a comprehensive business insurance package that provides proper protection without unnecessary overlaps or gaps in coverage.

We understand the specific risks facing Lockwood businesses and tailor solutions accordingly.

Why The Allen Thomas Group Outperforms Single-Carrier Agencies

Our independent insurance agency represents multiple top-rated insurance carriers, giving you more options than you’ll find with captive agents.

We’re not limited to a single company’s products or pricing structure.

The Allen Thomas Group difference:

- Personalized risk assessments identifying your specific vulnerabilities

- Regular policy reviews to keep coverage current with changing circumstances

- Claims advocacy throughout the entire process

- Carrier-neutral recommendations based on your best interests

- Deep expertise with Montana’s unique insurance landscape

We provide a consultative approach that ensures you receive coverage addressing your actual needs rather than one-size-fits-all solutions.

As your life evolves – through home renovations, new vehicles, growing families, or expanding businesses – we adjust your protection accordingly.

Montana Insurance Compliance: Avoiding Coverage Gaps

The Montana Commissioner of Securities and Insurance (CSI) regulates the insurance industry in our state and serves as an advocate for consumers in insurance disputes.

Our agents stay current with changing regulations to ensure your coverage remains compliant.

Key regulatory considerations:

- Workers’ compensation surcharges due within 20 days of each quarter’s end

- Auto insurance verification through the MTIVS system

- Minimum liability requirements for vehicle coverage

- State-specific guidelines for business insurance compliance

- Consumer protection resources through the CSI office

Montana’s unique geography and climate create specific insurance considerations.

From wildfire risks in forested areas to severe winter weather challenges, we help you understand how these factors affect your coverage needs and premiums.

Personal And Business Insurance Solutions in Lockwood, Montana Built For Your Needs

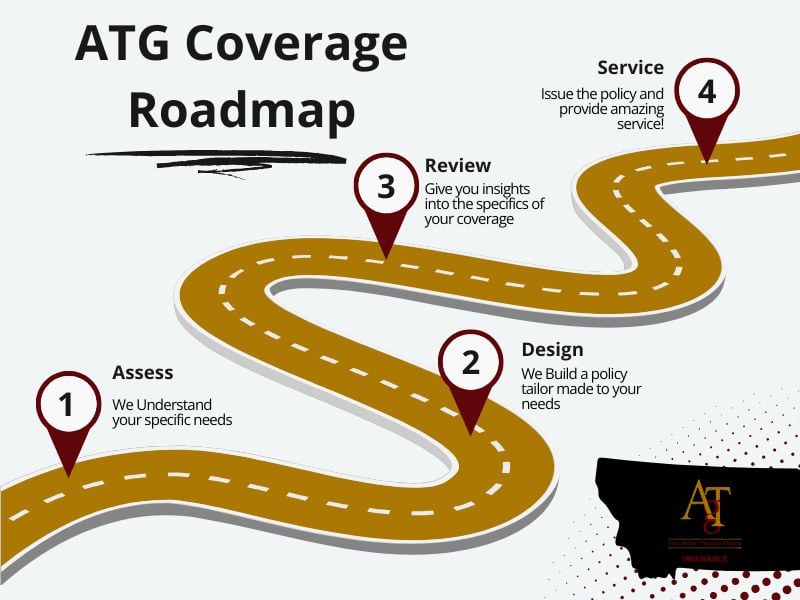

We know how frustrating and complex the process of finding the right independent insurance agent can be.

Let us help fix it for you in 3 easy steps!

Tell us about your specific needs and we will find the right policy for you.

Review the results of our search.

We will walk you through your new policy step by step.

Let Our Team Help You Out

Lower premiums don’t have to mean less coverage.

You just need a trusted agent serving Lockwood, Montana who knows where to look.

Contact Your Licensed Lockwood Insurance Broker For More Information and Get Resources That Matter

Our Carrier Partners

That allows us to find the best rates for your personal and business needs in Lockwood, MT

Initiate Your Free Policy Comparison

Securing the right insurance protection starts with a conversation.

Our licensed Lockwood agents take the time to understand your specific situation before recommending coverage options.

There’s no obligation, and the consultation is completely free.

How to connect with us:

- Call our office at (440) 826-3676

- Request information on our contact page.

- Schedule a policy review to identify potential improvements

- Ask about multi-policy discounts for bundling coverage

During your consultation, we’ll discuss your current coverage, identify potential gaps or overlaps, and explore ways to enhance protection while managing costs.

We explain insurance concepts in clear language without confusing jargon.

Zip codes We Serve In Lockwood

59037 / 59101

How does an independent agency differ from other insurance providers?

Independent agencies like The Allen Thomas Group represent multiple insurance carriers rather than a single company. This allows us to compare various options and find the best combination of coverage and price for each client’s specific needs. We work for you, not the insurance company.

How can I save money on my Lockwood, Montana insurance premiums?

Several strategies can help reduce costs without sacrificing protection:

- Bundling multiple policies with the same carrier

- Installing home security systems

- Maintaining a good driving record

- Selecting appropriate deductibles

- Taking advantage of all available discounts

Our agents identify all eligible savings opportunities for which you qualify.

Whether it’s data privacy liability, cyber security coverage, or professional indemnity insurance – we can provide tailored solutions to fit the exact needs of your business!

Our team of knowledgeable professionals has the experience and expertise to ensure you get maximum value out of your policy. Let us help safeguard all aspects of your tech venture today!

What factors affect home insurance rates in Lockwood?

Lockwood home insurance premiums are influenced by several factors:

- Home location and proximity to fire services

- Construction materials and age

- Replacement cost value

- Claims history and credit score

- Chosen deductible amount

- Wildfire risk zone designation

These variables combine to determine your specific premium rates.

Do I need special insurance for Lockwood, Montana's extreme weather conditions?

Standard homeowners policies typically cover damage from winter storms, including weight of ice and snow. However, flood damage requires separate coverage through the National Flood Insurance Program. Our agents help identify weather-related risks specific to your Lockwood property and ensure appropriate protection.

How do I know if I have enough liability coverage?

We recommend liability limits that protect your current assets and future earnings. For many Lockwood residents, the state minimum auto liability requirements of $25,000/$50,000/$20,000 prove insufficient in serious accidents. We help clients determine appropriate limits based on their individual financial situations.