Small businesses should consider various emerging technologies for risk management to enhance their digital security and compliance.

Technologies such as AI threat detection, cloud-based security, and multi-factor authentication can significantly improve data protection, incident response, and overall risk monitoring.

Identifying Key Risks for Small Businesses

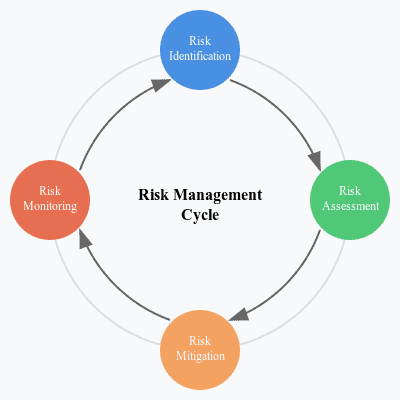

Small businesses encounter many risks that can impact growth and daily operations.

Recognizing these risks is vital for crafting effective risk management strategies.

Emerging Technologies and Their Role in Risk Management

Emerging technologies like artificial intelligence (AI) and machine learning offer smart solutions to improve risk management.

These tools can process large data sets quickly, helping small businesses spot potential threats early.

For example, AI-driven cybersecurity tools identify unusual patterns that may signal cyber attacks.

This allows businesses to take action before issues escalate.

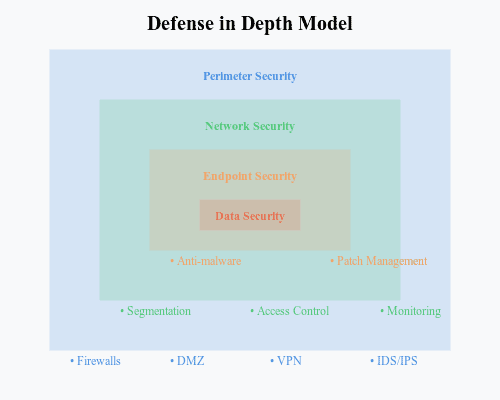

Cybersecurity Concerns

Cybersecurity is a major concern for small businesses due to the rise in cyber threats and the emergence of quantum computing.

It’s important to have strong cybersecurity measures in place to protect sensitive data from breaches.

This includes using firewalls, antivirus software, and regular system updates to fix any vulnerabilities.

Financial Risk Management

Financial risks can arise from various factors that affect profitability or cash flow. Small businesses should regularly check their financial health by budgeting and forecasting. This helps them manage risks effectively.

Business insurance serves as a crucial financial safeguard against various operational risks.

A comprehensive insurance strategy should include coverage for general liability, professional liability, property damage, business interruption, and cyber incidents.

By maintaining appropriate insurance policies, small businesses can transfer significant risks to insurers, protecting their assets and ensuring business continuity even when unexpected events occur.

Regular insurance policy reviews and updates ensure coverage remains aligned with evolving business needs and emerging risks.

Legal Risks

Legal challenges can pose significant threats if not handled properly.

Following compliance regulations, like data protection laws, is crucial to avoid fines and damage to reputation.

Regular legal audits ensure adherence to laws and highlight areas for improvement.

Reputational Risks

A company’s reputation is very important; thus, managing reputational risks is key for long-term success.

Negative publicity or customer dissatisfaction can lead to lost sales opportunities.

Addressing customer feedback through surveys or social media interactions helps maintain a positive public image.

Operational Risk Management

Operational risks come from internal processes failing due to mistakes or unexpected events like natural disasters or supply chain issues.

Clear operational procedures and contingency plans strengthen resilience against such events.

The Impact of Unmanaged Risks on Small Businesses

Failing to manage identified risks can lead to severe consequences that hinder growth and sustainability.

Consequences of Unmanaged Risks

- Unmanaged financial risk can create liquidity issues that limit daily operations and may lead to bankruptcy over time.

- Compliance regulations are getting stricter; failing to comply exposes companies legally and financially through heavy penalties.

- Data protection solutions must be a priority; weak safeguards may result in compromised client data, leading to a loss of trust among customers.

- Technology adoption matters too; outdated systems increase vulnerability, making it essential for firms to invest in modern infrastructure.

- Disaster recovery plans help ensure quick restoration after incidents, minimizing downtime and preserving productivity and team morale during crises.

Building a Proactive Risk Management Culture

Creating a work environment where employees understand risk management builds accountability across the organization.

Employee Awareness Training

Regular training sessions give employees the knowledge they need about potential security threats. This helps them recognize suspicious activities quickly, reducing response times when action is required. A well-trained staff safeguards company interests while ensuring business continuity.

Overall, small businesses must prioritize identifying and managing ri sks effectively. By doing so, they protect their operations and pave the way for sustainable growth.

Cybersecurity Solutions: Protecting Your Network and Data

Today, small businesses face many threats to their cybersecurity. Emerging technologies can help keep sensitive data safe and secure networks.

Important solutions include endpoint protection, network monitoring, multi-factor authentication (MFA), and access management systems.

Investing in these cybersecurity solutions including the right cyber liability insurance protects your business from breaches.

It also builds trust with customers who want their information safe. By using advanced technologies in your security plans, you can improve your overall protection.

Multi-factor Authentication and Access Management

Multi-factor authentication is key to modern data protection solutions. It adds security by requiring users to show different forms of identification before accessing sensitive information. This greatly lowers the chances of unauthorized access.

Access management systems work hand-in-hand with MFA. They make sure that only the right people can get into important company resources.

Using zero trust security principles helps by always checking user identities based on set rules instead of just assuming they are trustworthy.

Additionally, employee awareness training is essential for promoting best practices around cybersecurity.

Teaching staff about phishing attacks and safe browsing habits makes them a strong defense against cyber threats.

Endpoint Protection and Network Monitoring

Endpoint protection focuses on keeping devices like computers, smartphones, and tablets safe when they connect to your company’s network.

For small businesses, this is critical because each device could be a potential weak point if not secured properly.

Real-time monitoring helps organizations spot strange activities quickly—like unauthorized attempts to access files—which might mean someone is trying to break in.

Regular vulnerability scanning finds weaknesses in the system before bad actors can exploit them.

By combining good endpoint protection with strong network monitoring strategies, small businesses create an environment that reduces risks from cyber threats while also boosting overall efficiency.

Cloud-Based Security: Leveraging the Cloud for Enhanced Protection

Cloud-based security provides great benefits for businesses aiming to enhance their cybersecurity without spending a lot on traditional setups.

Using cloud services allows better compliance management tools that meet industry rules while offering flexible storage options with various data encryption methods designed specifically for protecting sensitive information during transfer or when stored.

Using cloud-based solutions guarantees that updates about new threats are integrated smoothly into current frameworks, keeping defenses strong against daily risks in today’s connected world.

Data Encryption and Security Automation

Data encryption is one of the best ways to stop unauthorized access if attackers manage to get control over stored materials with confidential details about clients’ transactions or other important info—keeping everything unreadable without the right keys!

Security automation improves response times through automated risk assessments, which help companies find vulnerabilities faster than doing it manually. This leads to quicker fixes, lowering the chances of serious problems caused by oversights mentioned earlier.

AI-Powered Threat Detection: Proactive Security Measures

AI (Artificial Intelligence) technology has revolutionized how organizations approach risk management, particularly in threat detection.

Modern AI-powered security systems employ multiple sophisticated algorithms to protect your business:

Core Detection Algorithms

- Anomaly Detection: Mathematical models that establish baseline behavior patterns and flag deviations. These systems typically achieve 95-98% accuracy in identifying unusual network activity.

- Pattern Recognition: Advanced algorithms that analyze historical threat data to identify similar attack signatures, reducing false positives to under 5%.

- Machine Learning Classification: Systems that categorize threats based on learned characteristics, with typical detection rates exceeding 90% for known attack types.

Implementation Roadmap for Small Businesses

- Initial Assessment (1-2 weeks)

- Evaluate current security infrastructure

- Define security objectives and compliance requirements

- Assess budget constraints

- Basic Implementation (2-4 weeks)

- Deploy endpoint monitoring solutions

- Implement basic AI threat detection

- Train staff on new security protocols

- Advanced Integration (4-8 weeks)

- Enable advanced threat detection features

- Integrate with existing security systems

- Fine-tune detection parameters

- Optimization (Ongoing)

- Regular system updates

- Performance monitoring

- Algorithm refinement

Cloud-Based Security: Enhanced Protection Protocols

Modern cloud security relies on multiple layers of protection to ensure data safety:

Encryption Standards

- AES-256 (Advanced Encryption Standard): The industry-standard symmetric encryption algorithm, using 256-bit keys to secure data at rest.

- TLS 1.3 (Transport Layer Security): The latest protocol for data-in-transit protection, reducing handshake latency to under 100ms while maintaining security.

- End-to-End Encryption: Ensures data remains encrypted throughout its entire journey from sender to recipient.

Hybrid Cloud Architecture

A hybrid cloud architecture combines private and public cloud resources:

Private Cloud Components

- Critical data storage

- Sensitive applications

- Compliance-regulated processes

Public Cloud Components

- Web applications

- Email services

- Collaboration tools

Minimum Security Requirements

- Multi-factor Authentication (MFA)

- Regular security audits

- Intrusion Detection Systems (IDS)

- Web Application Firewalls (WAF)

Data Protection Systems: Comprehensive Backup and Recovery

Backup Frequency Recommendations

Based on business size and data volume:

Small Business (1-50 employees)

- Critical Data: Daily incremental, weekly full backup

- Regular Data: Weekly incremental, monthly full backup

- Archive Data: Monthly full backup

Medium Business (51-200 employees)

- Critical Data: Hourly incremental, daily full backup

- Regular Data: Daily incremental, weekly full backup

- Archive Data: Weekly full backup

Recovery Metrics

- RTO (Recovery Time Objective):

- Critical Systems: < 4 hours

- Non-critical Systems: < 24 hours

- RPO (Recovery Point Objective):

- Financial Data: < 1 hour

- Customer Data: < 4 hours

- Other Business Data: < 24 hours

Technical Evaluation Criteria

When selecting backup solutions, consider:

- Compression ratios (typically 2:1 to 5:1)

- Deduplication efficiency (50-80% reduction)

- Recovery success rate (should exceed 98%)

- Backup completion time (within allocated window)

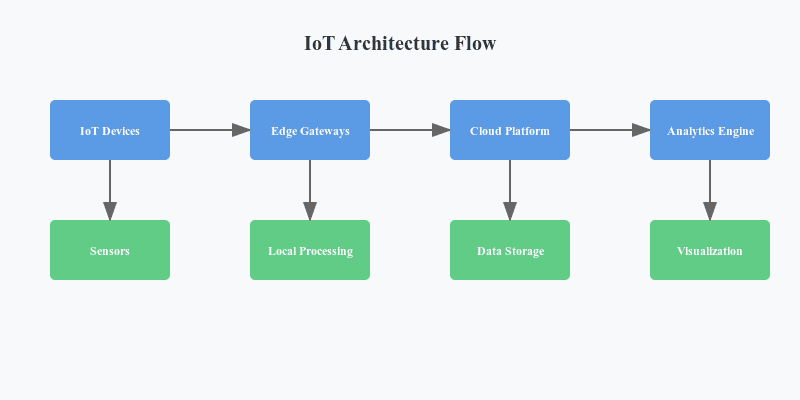

IoT Sensor Integration: Smart Monitoring Solutions

Technical Architecture

Sensor Types and Use Cases

Environmental Monitoring

- Temperature Sensors (±0.5°C accuracy)

- Humidity Sensors (±2% RH accuracy)

- Air Quality Sensors (PM2.5, CO2)

Security Monitoring

- Motion Detectors (5-15m range)

- Door/Window Sensors

- Surveillance Cameras (1080p+)

Equipment Monitoring

- Vibration Sensors

- Power Consumption Meters

- Pressure Sensors

Network Requirements

- Bandwidth:

- Basic Sensors: 1-10 Kbps per device

- Video Cameras: 0.5-2 Mbps per stream

- Gateway Uplink: Minimum 10 Mbps

- Storage:

- Sensor Data: 1-5 GB/month per 100 sensors

- Video Storage: 70-140 GB/month per camera

- Analytics Data: 10-20% of raw data volume

Operational and Communication Technologies for Risk Mitigation

Operational technologies are vital for managing risks, especially for small businesses. These tools help streamline processes and improve communication. By using advanced systems, companies can lower risks and boost efficiency.

Business Management Systems: Streamlining Operations and Reducing Risks

Business management systems are key for running operations smoothly.

Cloud-based ERP (Enterprise Resource Planning) solutions connect various applications that help with data governance, automate inventory systems, and enhance operational performance.

With these systems, businesses can centralize their information. This makes it easier to oversee finance, supply chain logistics, and human resources.

Adding IoT security measures strengthens risk management. It provides real-time insights into potential weaknesses in operations.

This combination not only improves workflows but also cuts down on errors that could lead to financial losses or compliance issues.

Cloud-based ERP and IoT Sensor Integration

Combining cloud solutions with IoT sensors enhances risk management for small businesses.

Cloud-based ERPs offer a scalable platform where data from IoT devices is collected and analyzed effectively.

For example, smart sensors can track equipment conditions or environmental factors in real time. This allows businesses to act quickly before problems arise.

These integrations also improve visibility across business functions while ensuring robust security protocols are maintained through effective data encryption methods.

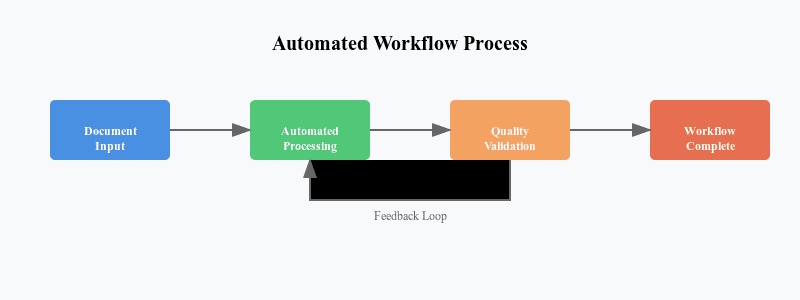

Smart Monitoring and Automated Inventory Management

Automated inventory management along with smart monitoring technologies represents a big step forward in operational efficiency.

Businesses can use automated inventory systems that employ RFID tags or barcode scanning technology to maintain accurate stock levels without needing manual checks.

Real-time monitoring lets managers receive instant alerts about stock issues or shortages.

These features help minimize disruptions from unexpected demand changes while reducing waste linked to overstocking—an issue many small businesses face today.

Enhancing Safety and Security with Operational Technologies

Using physical security technology is crucial for protecting assets and staff within a company’s premises.

Environmental monitoring systems keep track of factors like temperature and air quality, which directly affect employee health—ensuring safety standards are upheld.

In addition, emergency alert systems allow for quick communication during crises such as fires or natural disasters.

This preparedness helps protect lives while minimizing property damage through timely actions based on established disaster recovery plans.

Smart Surveillance and Access Control Systems

Modern surveillance technologies have changed how businesses address security concerns.

Access management systems with biometric authentication prevent unauthorized entry while creating secure workplaces where employees feel safe.

By employing advanced surveillance cameras along with AI-driven analytics software capable of identifying unusual behavior around facilities, companies can enhance vigilance against thefts.

This approach enables proactive rather than reactive asset protection measures.

Environmental Monitoring and Emergency Alert Systems

Environmental monitoring is critical for protecting staff welfare alongside company integrity!

Implementing emergency alert mechanisms ensures important notifications about potentially dangerous situations reach everyone quickly, allowing swift corrective actions based on previously established disaster recovery plans.

Process Automation: Improving Efficiency and Reducing Errors

Workflow automation is a foundation for successful modern-day enterprises!

By automating routine tasks like document processing across project stages, businesses can increase efficiency while lowering error rates seen in manual handling scenarios affected by inconsistent practices across departments.

Workflow Automation and Document Processing

Document processing software solutions significantly enhance operational effectiveness through diligent adherence to improvement strategies pursued until successful outcomes are reached rapidly without excessive effort!

Quality Control and Maintenance Scheduling

Effective maintenance scheduling tools support operational resilience practices by ensuring equipment stays in top shape while preventing unexpected breakdowns that can disrupt productivity!

Communication Technologies: Facilitating Effective Risk Management

Communication technologies support effective risk management through improved collaboration internally among teams as well as externally with vendors!

Internal Collaboration Platforms and Emergency Alert Systems

Crisis communication strategies ensure employees stay informed during emergencies.

Employee awareness training plays a key role in building a culture of safety within organizations!

External Communication Tools for Vendor Management and Crisis Communication

Strong customer communication strategies help manage vendor relationships during crises while enabling better incident response planning!

Selecting and Implementing Risk Management Technologies

In today’s fast-changing business world, small businesses need to focus on strong risk management strategies.

Emerging technologies can help improve cybersecurity and offer better data protection solutions.

By using cloud-based security systems and compliance management tools, organizations can protect their assets while staying within the law.

Cost Factors and Budget Planning for Technology Adoption

When thinking about technology adoption for risk management, budget planning is key.

Small businesses should look at different cost factors like:

- Initial investment costs

- Ongoing operational expenses

- Training needs

- Maintenance costs

Financial risk management means checking how much return on investment (ROI) these technologies can bring compared to what they cost.

Investing in advanced technologies often leads to better operations.

For example, automated backup solutions can lower downtime during data breaches or system failures, saving money on recovery.

Integration Requirements: Seamlessly Integrating New Technologies

Bringing in new technologies needs careful planning to prevent technical issues.

Businesses should think about how emerging technologies will work with their existing systems.

Compatibility checks are necessary before starting the implementation.

Change management is also important; organizations must prepare staff for updates by clearly explaining how to use new tools in daily tasks.

Staff Training and Technical Support Needs

Employee awareness training is very important when new risk management technologies are introduced.

Proper training helps team members learn how to use software effectively while reducing mistakes that could lead to cybersecurity problems.

Using training management software makes it easier to track employee progress and spot areas where more support may be needed.

Data Migration and Process Changes

As companies move to newer platforms, data governance becomes more important.

Strong disaster recovery plans protect sensitive information during migration while keeping in line with industry rules about data privacy.

It’s essential to communicate process changes clearly across all levels of the organization so employees know what they need to adjust in their workflows after tech upgrades.

Selecting Vendors for Risk Management Technologies

Choosing the right vendors is critical for effective risk management strategies that fit small businesses’ needs.

A good vendor selection process includes looking at potential partners’ success in delivering reliable cybersecurity frameworks that match your goals.

Compatibility checks guarantee that the selected vendors’ offerings will work smoothly with current systems without causing any issues or inefficiencies later on.

Risk Assessment Tools: Proactive Risk Identification and Analysis

In a digital environment, small businesses need to focus on risk management.

This helps protect their assets and meet compliance standards. Using emerging technologies can improve traditional risk assessment tools.

This approach allows businesses to spot and analyze threats early. Here, we’ll look at different risk assessment software, how predictive analytics play a role in managing risks, and how real-time monitoring systems keep everything in check.

Risk Assessment Software

Small business cybersecurity depends on strong data protection solutions. These should fit easily into current processes. Modern compliance management tools help businesses follow rules while making incident response planning easier.

With these software solutions, companies can run automated risk assessments quickly.

Automated features help find weaknesses fast by scanning networks for problems or strange activities.

By using these advanced tools, small businesses get a better understanding of their security without spending too many resources on manual checks.

Some key benefits of using effective risk assessment software include:

- Better Threat Detection: Automated systems keep an eye on network activity for any unusual behavior.

- Easier Compliance Management: Tools designed for following regulations make reporting less complicated.

- Improved Incident Response Planning: Quick identification of risks lets teams create action plans before problems get bigger.

Predictive Analytics

AI has changed the way businesses manage risks. Predictive analytics allows companies to use trend analysis in financial risk management smartly. By looking at past data patterns, these systems can predict future risks more accurately.

Predictive models explore different scenarios based on current trends, helping decision-makers put resources where they are needed most. For example:

- Businesses can forecast market changes that might affect their stability.

- Companies can assess the chances of cyberattacks by analyzing past incidents in similar sectors.

This kind of planning helps companies not just react but also set up their security around expected challenges.

Risk Monitoring Systems: Real-time Insights and Early Warning Signals

Real-time monitoring is key for keeping an organization ready against new threats.

Having strong performance monitoring systems ensures ongoing awareness throughout all operations—whether it’s network monitoring or vulnerability scanning practices.

Real-time Tracking and Alert Systems

When backed by real-time alerts, incident response planning works much better.

These systems give early warning signs about possible breaches or failures before they become serious problems needing extensive fixes.

Key features include:

- Instant Notifications: Alerts sent via email or SMS keep team members updated about urgent issues.

- Operational Resilience: Continuous tracking helps address any issues promptly, reducing downtime and risk.

- Data-driven Decisions: Accessing live metrics supports managers in making smart choices about resource allocation during emergencies.

Performance Monitoring

A solid performance monitoring plan directly leads to operational improvements across various business activities—ensuring strict adherence to security policies and procedures aimed at lowering risks during daily operations.

Focusing on both technological advancements and human factors within each area discussed shows why investing time into understanding these topics brings valuable benefits down the road!

Adapting to Emerging Technologies: Staying Ahead of the Curve

In today’s fast-paced business world, small businesses need to adapt to emerging technologies.

This helps improve their risk management strategies. Digital transformation is now a must if you want to stay competitive and strong.

By using technological advancements in security, companies can protect themselves better against new threats.

Emerging technologies like artificial intelligence (AI) and blockchain lead this change. AI applications are valuable for spotting potential risks early.

For example, predictive analytics can sift through lots of data to predict trends or find problems that could lead to security breaches or operational issues.

Blockchain technology adds more transparency and security in transactions. This makes it a useful tool for risk management. Its structure helps keep data safe, reducing weaknesses found in older systems.

As businesses consider future technology trends, investing in these innovations is crucial.

Not only do they help reduce risks, but they also foster overall business growth.

Technology Evolution and Innovation Adoption

Bringing in new technologies means you need a smart plan for adopting innovation in your company. Artificial intelligence applications have become key tools in today’s risk management practices.

AI-driven solutions help monitor and analyze business processes in real time.

This lets businesses react quickly when they spot risks.

Also, using cloud solutions gives companies scalable resources that boost operational resilience.

These platforms allow safe data storage while ensuring easy access from anywhere—especially vital during emergencies when you need remote access.

Cybersecurity frameworks based on these technologies are crucial for protecting sensitive information from unauthorized access or cyberattacks.

Learning how these frameworks work helps businesses build strong defenses against potential threats effectively.

Long-Term Technology Investment Strategies for Small Businesses

When thinking about long-term technology investment strategies, small businesses should create detailed budget plans focused on tech adoption.

Knowing the costs—like initial expenses compared to ongoing costs—is essential for keeping financial health while working on digital transformation goals.

Operational resilience relies on careful financial risk management practices that promote steady growth without stretching resources too thin.

Making sure your investment strategy aligns with clear goals allows funds to be used wisely across various projects aimed at improving capabilities over time instead of quick fixes.

By taking a proactive approach to technology investments now—and leaving room for future growth—your company can thrive amid rapid technological change.

The Allen Thomas Group: Your Partner in Risk Management

Handling vendor risk management requires expertise in compliance regulations along with creative ways to cut exposure throughout supply chains or partnerships today.

The current landscape brings challenges that need careful thought across multiple areas without sacrificing quality expectations set by stakeholders involved!

With solid experience in developing effective risk mitigation and commercial insurance strategies that align with industry best practices, The Allen Thomas Group is here to help clients achieve their goals efficiently while following all necessary legal obligations domestically and internationally!

Get The Right Insurance Coverage To Protect Your Companies Future

Frequently Asked Questions

What are the best risk assessment methodologies for small businesses?

Small businesses should consider qualitative and quantitative methodologies. These approaches help identify and analyze risks based on data and expert judgment.

How does operational technology support risk management?

Operational technology enhances efficiency. It streamlines processes and mitigates risks by integrating real-time monitoring and automated systems.

Why is risk exposure analysis important?

Risk exposure analysis helps identify vulnerabilities. It provides insights that guide businesses in prioritizing resources to mitigate risks effectively.

How can physical security technology protect a business?

Physical security technology deters theft and unauthorized access. Surveillance systems and access controls enhance safety in the workplace.

What future technologies should small businesses watch for?

Small businesses should monitor AI, blockchain, and IoT developments. These technologies can significantly improve risk management practices.

What are the benefits of adopting new technologies for risk management?

New technologies offer improved efficiency, better compliance, and enhanced data security. They also streamline processes for quicker incident response.

How do mobile technologies impact risk management?

Mobile technologies facilitate remote access to critical systems. This flexibility allows employees to respond quickly to potential risks from anywhere.

What are effective customer communication strategies during a crisis?

Clear, consistent messaging is vital during crises. Use multiple channels like email, social media, and direct notifications to keep customers informed.

Which collaborative tools can assist small businesses with risk management?

Tools like project management software promote teamwork on risk-related tasks. They enhance communication among team members working on compliance or cybersecurity initiatives.

Resources Used For The Article:

- https://www.cisa.gov/resources-tools/services?f%5B0%5D=service_topic%3A68

- https://www.nist.gov/cyberframework

- https://cloudsecurityalliance.org/blog/2022/04/23/cloud-security-best-practices-from-the-cloud-security-alliance

- https://www.sba.gov/blog/5-best-risk-management-strategies

- https://www.isaca.org/resources/it-risk#1

- https://www.comptia.org/content/research/cybersecurity-trends-research

- https://www.gartner.com/en/information-technology/research

- https://www.forrester.com/blogs/category/business-technology-bt/