Contractor insurance is a specialized set of coverage options designed to protect construction businesses from financial losses due to accidents, property damage, injuries, and lawsuits related to their work.

This essential business protection helps contractors manage risks inherent in the construction industry, from small renovation projects to large commercial builds.

Without proper insurance, contractors face significant financial vulnerabilities that could potentially bankrupt even successful operations.

Understanding Contractor Insurance Policies: The Foundation of Business Protection

Contractor insurance serves as a comprehensive financial safety net specifically tailored to the unique risks faced by construction professionals.

These policies protect against third-party bodily injury claims, property damage, professional errors, and employee injuries.

Unlike generalized business insurance, contractor coverage addresses industry-specific exposures such as structural damage, construction defects, and worksite accidents.

Personal insurance policies like homeowners or auto coverage explicitly exclude business activities. Your personal auto policy won’t cover accidents while transporting tools and materials for a job, and your homeowners policy won’t protect you from client lawsuits claiming faulty workmanship.

Consider that the average construction injury claim exceeds $42,000, while construction defect litigation can easily reach six or seven figures.

Contractor insurance transforms these potentially ruinous expenses into manageable, predictable costs through regular premium payments.

Essential Types of Insurance Every Contractor Needs

Contractor General Liability Insurance: Your First Line of Defense

Commercial general liability insurance covers third-party bodily injury, property damage, and advertising injury claims that arise from your business operations.

This foundational coverage protects contractors when clients or visitors are injured at your worksite, when your work damages client property, or when you’re accused of libel, slander, or copyright infringement in your business communications.

Key protections include:

- Bodily and personal injury to non-employees at your worksite

- Damage to client property during your operations

- Completed operations coverage for problems arising after project completion

Here is an article about the average cost of General Liability Insurance for Contractors.

Workers’ Compensation Insurance: Protecting Your Most Valuable Assets

Workers’ compensation insurance covers medical expenses, rehabilitation costs, and lost wages for employees injured on the job.

This mandatory coverage in most states also protects employers from lawsuits related to workplace injuries.

For contractors with employees, this insurance isn’t optional – it’s a legal requirement with significant penalties for non-compliance.

Remember that in many states, even subcontractors may be considered your employees if they don’t have their own workers’ compensation coverage, creating additional liability exposure.

Commercial Auto Insurance: Coverage Beyond Personal Policies

Commercial auto liability insurance covers vehicles used for business purposes, protecting against bodily injury and property damage claims from accidents.

Whether you have a fleet of trucks or occasionally use personal vehicles for business, commercial auto coverage is essential for contractors who transport tools, materials, or personnel.

Standard personal auto policies exclude business use, creating dangerous coverage gaps for contractors who drive to job sites, pick up materials, or transport equipment.

Professional Liability (Errors & Omissions): Safeguarding Your Expertise

Professional liability insurance protects contractors against claims of negligence, errors, or failures in providing professional services.

Also known as errors and omissions (E&O) insurance, this coverage is particularly important for contractors involved in design work, consulting, or specialized installations where expertise is a key component of services.

For example, if you’re a design-build contractor and your plans contain an error that later causes structural issues, professional liability coverage helps defend against resulting claims.

Additional Coverage Options to Consider for Complete Protection

Builder’s Risk Insurance: Securing Projects Under Construction

Builder’s risk insurance protects structures and materials during construction, renovation, or remodeling projects.

This specialized commercial property insurance coverage guards against losses from fire, theft, vandalism, weather events, and other perils that could damage work in progress.

Coverage typically extends from project commencement until completion or occupancy.

Equipment & Tools Insurance (Inland Marine): Protecting Your Operational Assets

Equipment and tools insurance, often called inland marine insurance, protects the valuable machinery, tools, and equipment contractors rely on daily.

This coverage follows your equipment wherever it goes – to multiple job sites, in storage, or in transit – providing protection against theft, damage, and vandalism.

Given that equipment theft alone costs contractors millions annually, with the average equipment theft valued at over $30,000, this protection is vital for business continuity.

Umbrella/Excess Liability: Extending Your Coverage Limits

Umbrella liability insurance provides additional coverage limits beyond your primary policies, offering extra protection for severe or catastrophic claims.

This supplemental insurance will cover you when underlying policies reach their limits, providing crucial added protection for severe accidents or major lawsuits.

For larger projects or high-value commercial work, clients often require higher liability limits that umbrella policies can efficiently provide.

Legal Requirements and Compliance: What the Law Demands

State-Specific Insurance Mandates for Contractors

Insurance requirements vary significantly by state, with minimum coverage types and limits established by law.

For example, Ohio mandates a minimum of $500,000 in general liability coverage, while California requires contractors to carry at least $1 million in aggregate coverage for operations with five or fewer personnel.

Nearly every state requires:

- Workers’ compensation for any business with employees

- Commercial auto liability for business-owned vehicles

- General liability (often as a prerequisite for licensing)

Licensing Board Requirements and Insurance Prerequisites

State licensing boards typically establish insurance requirements as conditions for obtaining and maintaining contractor licenses.

These boards may suspend or revoke licenses for insurance lapses, effectively shutting down operations until proper coverage is restored.

Always verify current requirements with your state’s licensing board as these can change periodically with regulatory updates.

Project Contract Insurance Obligations: What Clients Expect

Beyond legal requirements, project contracts often impose additional insurance obligations.

Commercial clients, government agencies, and even residential customers increasingly specify insurance requirements in their contracts, including coverage types, limits, and special endorsements.

Failure to meet these requirements can result in contract termination, payment withholding, or legal disputes.

Here you can learn more about additional construction compliance guidelines.

The Real Cost of Going Uninsured or Underinsured

Financial Vulnerability: Potential Litigation and Settlement Costs

The financial impact of operating without adequate insurance can be devastating.

A single serious accident or major property damage claim can exceed $1 million in liability exposure. Without insurance, contractors face:

- Out-of-pocket legal defense costs (often $300-500 per hour)

- Settlement or judgment payments with no limits

- Business asset seizure to satisfy judgments

- Personal asset exposure if business assets are insufficient

Even seemingly minor incidents can escalate into significant claims.

A simple slip and fall can generate $50,000+ in medical costs and lost wages, while a small fire from hot work could cause hundreds of thousands in property damage.

Opportunity Costs: Lost Contracts and Business Opportunities

Inadequate insurance severely limits your business growth opportunities. Many clients and general contractors won’t consider uninsured or underinsured subcontractors due to the liability exposure they represent.

This results in:

- Disqualification from government contracts

- Rejection by commercial clients with insurance requirements

- Inability to work with larger general contractors

Reputation Damage: The Hidden Long-Term Expense

Beyond immediate financial impacts, insurance problems create lasting reputation damage. Word travels quickly among general contractors and property owners about contractors who cut corners on insurance or have coverage issues.

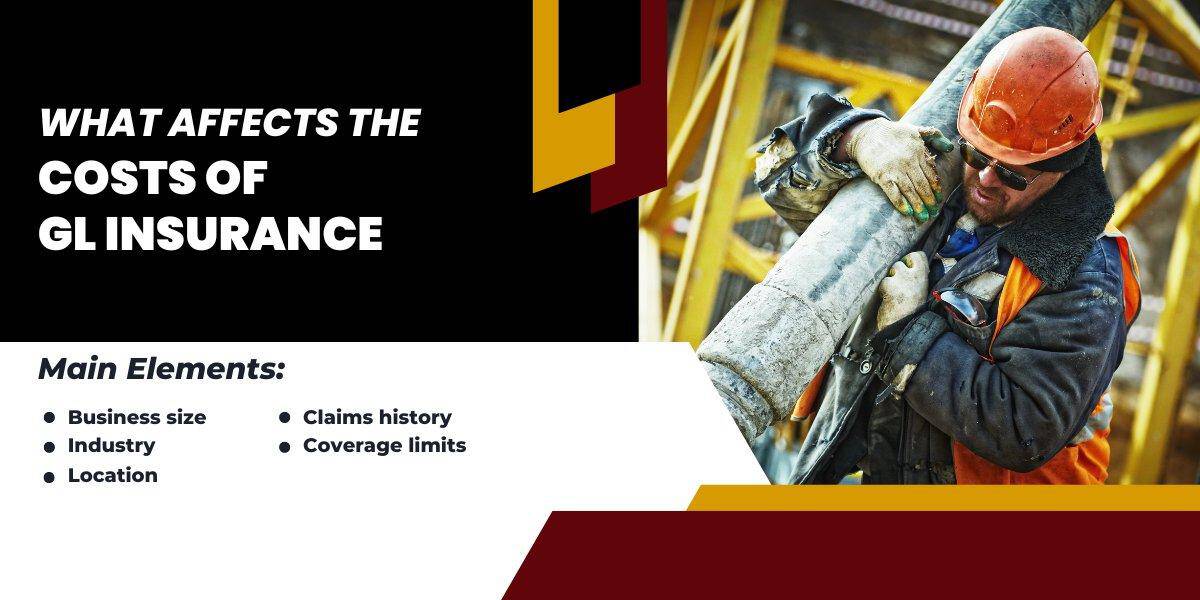

Strategic Approaches to Contractor Insurance Cost

Assessing Your Specific Risk Profile

Effective insurance planning begins with a thorough assessment of your business’s specific risk exposures.

Consider factors like:

- The types of projects you typically undertake

- The size and value of these projects

- Number of employees and their roles

- Equipment values and mobility requirements

A roofing contractor working on three-story buildings has different risk exposures than a landscape contractor primarily working on ground level projects. Understanding these differences helps tailor coverage to actual needs.

Balancing Coverage Adequacy Against Premium Costs

While comprehensive coverage is important, independent contractors must balance protection with affordability.

Strategic approaches include:

- Higher deductibles to lower premiums while maintaining coverage limits

- Bundling policies with one carrier for multi-policy discounts

- Implementing strong risk management practices to qualify for preferred rates

Insurance should be viewed as a business investment rather than an expense – providing essential protection while remaining proportionate to your operation’s size.

Working with Specialized Brokers vs. General Agencies

Not all insurance providers have equal expertise in contractor coverage.

Agencies specializing in construction insurance, like The Allen Thomas Group, offer significant advantages:

- In-depth understanding of construction risks and coverage needs

- Relationships with insurance companies that specialize in contractor policies

- Knowledge of state-specific requirements and market conditions

Policy Components That Demand Your Attention

Coverage Limits: Per-Occurrence vs. Aggregate Considerations

Understanding the difference between per-occurrence and aggregate limits is crucial for adequate protection.

Per-occurrence limits apply to each individual claim, while aggregate limits cap the total the insurer will pay during the policy period regardless of the number of claims.

For example, a $1 million per-occurrence/$2 million aggregate general liability policy would cover individual claims up to $1 million each, with a maximum total payout of $2 million for all claims during the policy year.

Deductibles: Impact on Premiums and Financial Planning

Deductibles represent your financial responsibility before insurance coverage activates.

Higher deductibles generally reduce premiums but increase out-of-pocket costs when claims occur.

When selecting deductibles, consider your business’s cash flow and reserves for covering deductibles.

Exclusions and Endorsements: Reading the Fine Print

Standard contractor policies contain numerous exclusions – specific situations or perils not covered.

Understanding these exclusions and addressing critical gaps through endorsements (policy modifications) is essential for comprehensive protection.

Common critical exclusions include subcontractor work exclusions, height restrictions, specific operations exclusions, and pollution liability exclusions.

Managing Your Insurance Program Effectively

Documentation and Certificate Management

Proper documentation management is a crucial but often overlooked aspect of contractor insurance. This includes maintaining current certificates of insurance for your business and certificates from all subcontractors (updated regularly).

Implementing a systematic approach to certificate tracking ensures you can quickly provide proof of insurance when required and verify subcontractor coverage to prevent assumed liability.

Claims Procedures: Being Prepared Before Incidents Occur

Knowing how to properly handle claims before incidents occur can significantly impact outcomes. Establish clear procedures for immediate incident documentation, prompt reporting to your insurance carrier, and evidence preservation at accident sites.

Proper claims handling not only facilitates faster resolution but often reduces claim severity and protects your loss history.

Regular Policy Reviews and Updates as Your Business Evolves

Contractor insurance isn’t a set-and-forget arrangement. As your business grows, diversifies, or changes focus, your insurance needs evolve. Schedule annual reviews with your agent to adjust coverage limits based on revenue growth and add protection for new operations or services.

Taking the Next Step: Securing the Right Coverage

Questions to Ask Potential Insurance Providers

When evaluating insurance options, ask potential providers these critical questions:

- How much experience do you have with contractors in my specific trade?

- Which insurance carriers do you represent that specialize in construction?

- How do you handle claims advocacy for your clients?

The answers reveal whether the provider truly understands contractor needs or simply sells generic business policies.

Required Information for Accurate Quotes

To obtain accurate insurance quotes, prepare to provide:

- Detailed description of operations and services

- Revenue projections and breakdown by service type

- Payroll information by employee classification

- Loss history for the past 3-5 years

The more complete and accurate this information, the more precise your quotes will be, preventing surprises at policy issuance.

The Value of a Tailored Approach to Contractor Insurance

Generic, one-size-fits-all insurance approaches inevitably create either coverage gaps or unnecessary expenses for contractors.

A tailored approach aligns protection precisely with your business model, providing comprehensive coverage for actual risks while eliminating unnecessary coverage for exposures you don’t have.

Don’t Leave Your Business Vulnerable

Your contracting business faces unique risks that require specialized protection.

Don’t settle for generic coverage that leaves dangerous gaps in your financial safety net.

The Allen Thomas Group has over 20 years of experience crafting customized insurance solutions for contractors across all trades and sizes.

Protect your business with the appropriate coverage by contacting us today at (440) 826-3676 for a comprehensive insurance review and personalized recommendations.

Our experienced commercial insurance agents understand contractor operations and will ensure you have the right protection at competitive rates.

Don’t wait until a claim reveals coverage gaps – secure your business with properly structured insurance today.

Get Precise Risk Management Solutions and Insurance Coverage For Contractors

It Just Takes A Few Clicks

Source and Citation Notes

- The average construction injury claim exceeds $42,000 (National Safety Council, 2024)

- Construction defect litigation can easily reach six or seven figures (JRC Insurance Group, 2023)

- Equipment theft costs contractors millions annually, with the average equipment theft valued at over $30,000 (National Equipment Register, 2023)

- Ohio mandates a minimum of $500,000 in general liability coverage (EInsurance, 2023)

- California requires contractors to carry at least $1 million in aggregate coverage for operations with five or fewer personnel (Contractors Liability, 2024)

- Workers’ compensation is mandatory coverage in most states (Embroker, 2024)

- Legal requirement with significant penalties for non-compliance (The AA Insurance, 2023)

- A single serious accident or major property damage claim can exceed $1 million in liability exposure (Landesblosch Insurance, 2024)

- Small fires from hot work could cause hundreds of thousands in property damage (Construction Coverage, 2024)