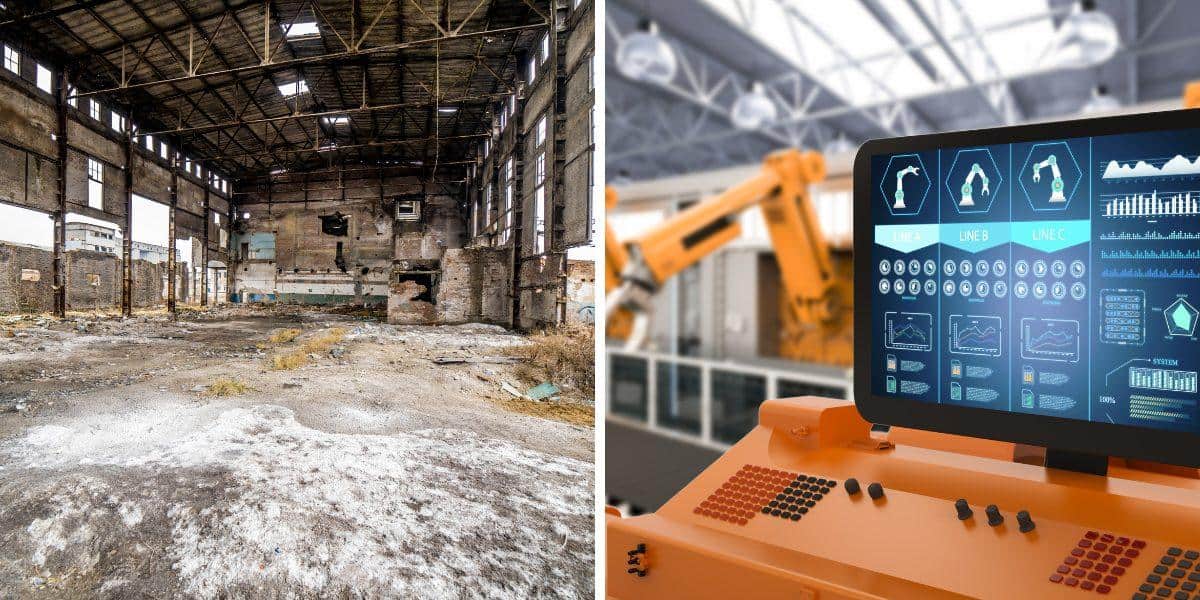

Navigating the world of manufacturing insurance can seem like a daunting task, but it’s a crucial step in safeguarding your business against the unexpected.

Whether you’re dealing with the nuts and bolts of production or the complexities of distribution, understanding the ins and outs of manufacturing insurance is key to ensuring your operation runs smoothly, no matter what comes your way.

From equipment malfunctions to supply chain hiccups, this article dives into why manufacturing insurance is not just a safety net but a vital component of your business strategy.

We’ll explore the factors influencing costs, the types of coverage needed, and tips for keeping those costs in check.

So, buckle up as we breakdown manufacturing insurance costs and show you how to protect your business without breaking the bank.

What is Manufacturing Insurance?

Manufacturing insurance is a specialized form of coverage designed to protect businesses involved in the production and distribution of goods against a wide range of risks.

This type of insurance is essential for manufacturers as it addresses the unique challenges and hazards they face, including equipment breakdown, supply chain disruptions, product liability, and employee safety concerns.

By providing financial protection against such risks, manufacturing insurance helps ensure that businesses can continue operations even in the face of unforeseen events.

For instance, in 2022, a mid-sized automotive parts manufacturer faced a significant setback when a fire damaged their main production facility.

Their comprehensive manufacturing insurance policy covered not only the property damage but also the business interruption losses, allowing them to recover and resume operations within months.

Manufacturing insurance typically includes various policies, such as property insurance, liability insurance, and business interruption insurance, each tailored to meet the specific needs of manufacturing entities.

These policies benefit a wide range of manufacturing operations, including:

- Food and beverage production

- Textile manufacturing

- Electronics assembly

- Automotive parts manufacturing

- Pharmaceutical production

- Furniture making

- Chemical manufacturing

For example, a food manufacturer might rely heavily on product liability coverage to protect against potential contamination claims, while a heavy machinery manufacturer might prioritize equipment breakdown coverage to safeguard against production halts due to machine failures.

As manufacturers navigate the complexities of producing and distributing products, having comprehensive insurance coverage becomes crucial to safeguard their assets, employees, and the future of their business.

In 2023, a small plastics manufacturer avoided bankruptcy when their insurance covered a $2 million lawsuit related to a faulty component, highlighting the critical role of product liability coverage in the manufacturing sector.

By understanding and implementing the right insurance coverage, manufacturers can focus on innovation and growth, knowing they have a financial safety net in place for unexpected challenges.

Why is Manufacturing Insurance Important?

Manufacturing insurance is crucial because it protects against a variety of risks that could otherwise devastate a business financially.

Here’s why it’s so important:

Protects against product liability claims

- Manufacturing insurance shields businesses from financial losses due to lawsuits related to product failure.

- Statistics: The average product liability claim in the manufacturing sector is over $7 million, according to a study by the Insurance Information Institute in 2020.

Covers property damage

- This insurance safeguards physical assets from harm caused by fire, theft, and natural disasters.

- Data point: The National Fire Protection Association reports that U.S. fire departments respond to an average of 37,000 fires at industrial or manufacturing properties each year, with direct property damage averaging $1.2 billion annually.

Guards against business interruption

- Manufacturing insurance helps recover lost income during periods of forced shutdowns.

- Industry insight: A study by the Business Continuity Institute found that 56% of companies experience a significant business interruption each year, with the average cost of downtime in manufacturing estimated at $260,000 per hour.

Protects against supply chain disruptions

- While not mentioned in the original content, this is a crucial aspect of manufacturing insurance.

- Key statistic: 94% of Fortune 1000 companies experienced supply chain disruptions due to COVID-19, with 75% reporting negative or strongly negative impacts on their business.

Safeguards against cyber threats

- As manufacturing becomes increasingly digitized, cyber insurance is becoming essential.

- Alarming fact: The manufacturing sector accounted for 23% of all ransomware attacks in 2021, with the average cost of a data breach in manufacturing reaching $4.24 million.

By providing comprehensive protection against these risks, manufacturing insurance plays a key role in maintaining the stability and continuity of operations.

It not only protects against immediate financial losses but also helps preserve a company’s reputation and customer relationships in the face of unexpected events.

For instance, when a medium-sized electronics manufacturer faced a recall due to a faulty component in 2022, their product liability insurance covered not only the $5 million in direct costs but also legal fees and PR expenses, allowing the company to navigate the crisis without long-term damage to their brand.

What Factors Influence Manufacturing Insurance Costs?

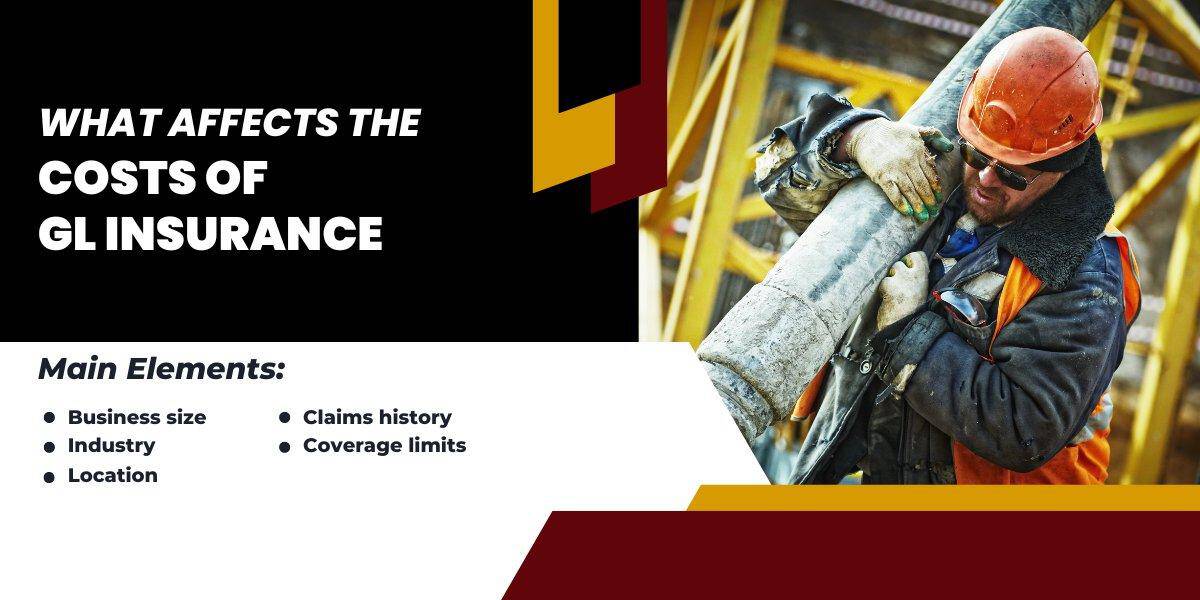

Several key factors determine the cost of manufacturing insurance.

Understanding these can help manufacturers better anticipate their insurance expenses and explore ways to manage them effectively.

- Location of the Manufacturing Facility

- Facilities in high-risk areas often face higher premiums due to increased risk of damage or loss.

- Example: A manufacturer in coastal Florida might pay up to 40% more for property insurance compared to a similar facility in inland Ohio due to hurricane risks.

- Industry insight: Flood-prone areas can see premiums up to 3-5 times higher than those in low-risk zones.

- Type and Value of the Products Manufactured

- High-value or hazardous products typically lead to higher premiums because of the greater potential financial risk involved.

- Real-world comparison: A pharmaceutical manufacturer producing high-value drugs might pay 2-3 times more for product liability insurance than a furniture manufacturer with similar revenue.

- Hazardous products: Chemical manufacturers often face premiums 50-100% higher than non-hazardous product manufacturers due to increased risks.

- Revenue of the Manufacturing Business

- Higher revenue companies potentially face higher premiums due to their larger scale of operations.

- Average cost difference: A manufacturer with $10 million in annual revenue might pay around $5,000-$10,000 annually for general liability insurance, while a company with $100 million in revenue could pay $50,000-$100,000 or more.

- Number of Employees

- More employees can increase liability risks, affecting the overall insurance cost.

- Workers’ compensation example: A manufacturer with 50 employees in a moderate-risk industry might pay around $50,000 annually for workers’ comp, while a similar company with 200 employees could pay upwards of $200,000.

- Claims History

- A history of frequent or severe claims can significantly impact insurance costs.

- Industry statistic: Manufacturers with no claims in the past 3-5 years can enjoy premiums up to 25% lower than those with multiple claims.

- Safety Measures and Risk Management

- Robust safety protocols and risk management can lead to lower premiums.

- Cost savings example: Implementing a comprehensive safety program could result in premium reductions of 10-15% or more.

- Coverage Limits and Deductibles

- Higher coverage limits increase premiums, while higher deductibles can lower them.

- Practical example: Increasing a deductible from $1,000 to $10,000 on a property insurance policy could potentially reduce premiums by 10-20%.

- Industry-Specific Risks

- Some manufacturing sectors face unique risks that impact insurance costs.

- Sector comparison: Food manufacturers might pay 15-25% more for liability insurance compared to textile manufacturers due to the higher risk of contamination and recalls.

By considering these factors, manufacturers can work with insurance providers to tailor policies that offer comprehensive protection while managing costs effectively.

For instance, a mid-sized automotive parts manufacturer in Michigan was able to reduce their overall insurance costs by 18% by implementing advanced safety measures, adjusting their deductibles, and bundling multiple policies with a single provider.

How Can Manufacturers Reduce Their Insurance Costs?

Manufacturers can lower their insurance costs by implementing several strategic measures.

Implementing safety measures in the workplace can significantly reduce the likelihood of accidents and claims, leading to lower premiums.

Training employees on safety protocols is another effective strategy; well-trained employees are less likely to be involved in accidents, which can lower a company’s risk profile.

Additionally, choosing a higher deductible can lead to lower premium costs, although it means higher out-of-pocket expenses in the event of a claim. By adopting these approaches, manufacturers can not only create a safer work environment but also enjoy the financial benefits of reduced insurance costs.

Implementing Safety Measures

Implementing safety measures significantly reduces the likelihood of accidents and claims, which can lead to lower insurance costs.

Training Employees on Safety Protocols

Training employees on safety protocols not only ensures their well-being but also lowers the company’s risk profile, potentially reducing insurance premiums.

Choosing a Higher Deductible

Opting for a higher deductible can result in lower premium costs. However, this approach means higher out-of-pocket expenses in the event of a claim.

What Types of Insurance Do Manufacturers Typically Need?

Manufacturers typically require a range of insurance policies to fully protect their operations, assets, and employees.

Here are the key types of insurance most manufacturers need:

- General Liability Insurance

- Covers third-party bodily injury and property damage.

- Example: A visitor slips and falls in your factory, sustaining injuries. General liability covers the medical expenses and potential lawsuit.

- Typical coverage: $1-$2 million per occurrence.

- Product Liability Insurance

- Protects against claims of product-related harm.

- Scenario: Your manufactured automotive part fails, causing a car accident. Product liability covers legal fees and settlements.

- Industry insight: In 2022, the average product liability claim in manufacturing was $5.4 million.

- Property Insurance

- Covers physical assets of the business against damage or loss.

- Example: A fire damages your production equipment. Property insurance covers repair or replacement costs.

- Key coverage: Often includes business interruption insurance to cover lost income during downtime.

- Workers’ Compensation Insurance

- Provides benefits to employees for work-related injuries or illnesses.

- Scenario: An employee injures their back while operating machinery. Workers’ comp covers medical bills and lost wages.

- Legal requirement: Mandatory in most states, with specific rules varying by location.

- Commercial Auto Insurance

- Covers vehicles used for business purposes.

- Example: Your delivery truck is involved in an accident. Commercial auto insurance covers damages and potential liability.

- Important note: Personal auto policies typically don’t cover business use.

- Cyber Liability Insurance

- Protects against data breaches and cyber attacks.

- Scenario: A ransomware attack encrypts your production data. Cyber insurance covers ransom payments, system restoration, and potential lawsuits.

- Growing trend: Manufacturing accounted for 65% of industrial ransomware incidents in 2022.

- Equipment Breakdown Insurance

- Covers repairs or replacement of failed equipment.

- Example: A critical CNC machine fails unexpectedly. This insurance covers repair costs and potentially lost production time.

- Cost-saving tip: This can be more cost-effective than extended warranties on individual machines.

- Environmental Liability Insurance

- Covers costs related to pollution or environmental damage.

- Scenario: A chemical spill at your facility contaminates local groundwater. This insurance covers cleanup costs and potential fines.

- Sector-specific: Particularly important for chemical, pharmaceutical, and heavy industry manufacturers.

- Professional Liability Insurance

- Also known as Errors and Omissions (E&O) insurance, it covers claims of negligence or failure to perform.

- Example: Your company provides faulty design specifications to a client, leading to product failure. This insurance covers resulting legal costs and damages.

- Crucial for: Manufacturers offering design services or custom solutions.

- Business Interruption Insurance – Covers lost income during periods when you can’t operate due to covered events.

- Scenario: A major storm damages your facility, forcing a shutdown. This insurance covers ongoing expenses and lost profits during repairs.

- Statistics: The average claim cost for business interruption insurance in manufacturing operations is approximately $2.38 million, which is 36% higher than the average direct property damage loss of $1.75 million.

.

By combining these insurance types, manufacturers create a comprehensive safety net that protects against a wide range of potential risks.

For instance, a medium-sized electronics manufacturer in California might have a policy package including general liability ($2 million coverage), product liability ($5 million coverage), property insurance (covering $10 million in assets), workers’ comp (as required by state law), and cyber liability ($1 million coverage), with an annual premium totaling around $50,000-$75,000, depending on their specific risk profile and claims history.

Remember, the exact insurance needs can vary based on the specific nature of your manufacturing business, location, size, and risk factors.

It’s crucial to work with an experienced insurance provider to tailor a comprehensive package that addresses your unique needs and risks.

How to Choose the Right Insurance Provider?

Selecting the right insurance provider is crucial for manufacturers to ensure comprehensive coverage tailored to their specific needs.

Here’s how to make an informed choice:

- Compare Coverage Options

- Not all policies cover the same risks, making it essential to carefully compare coverage options.

- Tip: Look for providers offering industry-specific policies for manufacturing.

- Evaluate the Insurer’s Financial Stability

- Choose an insurer with strong financial stability to ensure they can reliably pay out claims.

- Key metric: Check A.M. Best ratings – aim for providers with A ratings or higher.

- Consider Customer Service and Claims Support

- Efficient claims processing can significantly mitigate losses and reduce downtime.

- Best practice: Look for providers offering 24/7 claims support and dedicated manufacturing specialists.

- Assess Industry Expertise

- Providers with specific experience in manufacturing insurance will better understand your needs.

- Question to ask: “How long have you been serving the manufacturing sector?”

- Review Policy Flexibility

- Look for providers willing to tailor policies to your specific manufacturing niche.

- Example: A provider offering specialized coverage for food manufacturing risks or heavy machinery breakdown.

Recommended Insurance Providers for Manufacturers:

While the best provider can vary based on specific needs, here are some reputable insurers known for their manufacturing coverage:

- Cincinnati Insurance

- Known for comprehensive property and liability coverage for manufacturers as well as its Worldwide General Liability Extension which expands the coverage territory to all parts of the world except where a United States economic or trade sanction or travel ban is in effect.

- Offers specialized crime and higher limit umbrella policies policies.

- The Hartford

- Provides tailored insurance solutions for various manufacturing sectors.

- Offers strong workers’ compensation programs with return-to-work initiatives.

- Travelers Insurance

- Offers a wide range of coverages specific to manufacturers, including cyber liability.

- Known for strong risk control services to help prevent losses.

- Liberty Mutual

- Provides comprehensive coverage for large manufacturers.

- Offers specialized product liability and equipment breakdown coverage.

| Criteria | Questions to Ask | Importance |

|---|---|---|

| Financial Strength | What is their A.M. Best rating? | Critical |

| Manufacturing Expertise | How many years of experience in manufacturing insurance? | High |

| Claims Process | What is their average claim processing time? | High |

| Risk Management Services | Do they offer risk assessment and prevention services? | Medium |

| Policy Customization | Can they tailor policies to your specific manufacturing niche? | High |

| Multi-Policy Discounts | Do they offer bundling discounts for multiple coverages? | Medium |

| International Coverage | Can they provide coverage for overseas operations or exports? | Varies |

| Cyber Insurance Options | What specific cyber risks do their policies cover? | Increasing |

| Client References | Can they provide references from similar manufacturers? | Medium |

| Premium Competitiveness | How do their premiums compare to other providers for similar coverage? | High |

Remember, the best insurance provider for your manufacturing business will depend on your specific needs, location, size, and risk profile.

It’s often beneficial to work with an experienced independent insurance broker at The Allen Thomas Group who can provide quotes and comparisons from multiple providers.

What are Common Misconceptions about Manufacturing Insurance?

Several misconceptions about manufacturing insurance persist in the industry.

Let’s knock out these myths one by one with data and real-world examples:

- “It’s Too Expensive and Not Worth the Cost”

This is perhaps the most common misconception. However, the reality is that proper coverage can save money in the long run by protecting against significant financial losses.

- Data point: The average cost of manufacturing insurance ranges from 0.5% to 1.5% of annual revenue, while the average product liability claim is $7.6 million.

- Real-world example: In 2022, a small tool manufacturer in Ohio paid $15,000 annually for comprehensive insurance. When faced with a $2.3 million product liability lawsuit, their insurance covered all legal fees and settlements, saving the company from potential bankruptcy.

- “Only Large Manufacturing Operations Need It”

Many small and medium enterprises believe they don’t need comprehensive insurance. In reality, smaller operations often face higher relative risks due to less financial cushioning.

- Statistics: 43% of cyberattacks target small businesses, with the average cost of a data breach for small companies being $2.98 million.

- Case study: A 10-employee electronics manufacturer in California suffered a fire in 2023. Their $8,000 annual insurance premium resulted in a $750,000 payout, covering property damage and business interruption, allowing them to rebuild and retain all employees.

- “All Policies Offer the Same Coverage”

This misconception can lead to inadequate protection. Policies and providers vary widely in terms of coverage and service.

- Industry insight: A survey by the National Association of Manufacturers found that 72% of manufacturers who switched insurance providers in the past year did so because they found policies better tailored to their specific needs.

- Example: A food manufacturer switched from a general business policy to a specialized manufacturing policy, gaining critical coverage for contamination risks and recall expenses not covered in their previous policy.

- “Insurance is Only Necessary for Catastrophic Events”

Many manufacturers believe insurance is only for major disasters, overlooking its importance in day-to-day operations.

- Data: 60% of manufacturing insurance claims are for amounts under $50,000, covering issues like minor equipment breakdowns or small liability incidents.

- Real-life scenario: A Michigan-based auto parts manufacturer relied on their equipment breakdown coverage 12 times in one year for repairs averaging $7,500 each, far exceeding their annual premium of $22,000.

- “Self-Insurance is More Cost-Effective”

Some manufacturers believe setting aside funds for potential incidents (self-insurance) is more economical than paying premiums.

- Financial reality: A typical manufacturer would need to set aside 15-20% of their annual revenue to self-insure adequately against potential major claims.

- Comparative example: A medium-sized textile manufacturer considering self-insurance calculated they would need a reserve fund of $5 million to adequately protect against potential risks. Their annual insurance premium for comprehensive coverage was just $85,000.

- “Insurance Companies Always Try to Avoid Paying Claims”

While claim disputes do occur, reputable insurers have a vested interest in fair and prompt claim settlements.

- Industry data: In 2022, the insurance payout rate for manufacturing claims was 92%, with an average claim processing time of 14 days for standard claims.

- Success story: When a Wisconsin-based plastics manufacturer faced a $1.2 million equipment failure, their insurer not only covered the full cost but also provided a loss prevention specialist to help prevent future incidents.

By understanding these realities, manufacturers can make more informed decisions about their insurance needs.

The right insurance coverage is not just an expense, but a critical investment in your business’s long-term stability and success.

Protecting Your Manufacturing Business: The Smart Way Forward

As we’ve explored throughout this article, manufacturing insurance is not just a safety net—it’s a crucial component of your business strategy.

From safeguarding against product liability claims to protecting your assets and employees, the right insurance coverage can mean the difference between weathering a storm and facing financial ruin.

Remember:

- Manufacturing insurance is an investment, not just an expense

- Costs vary based on factors like location, product type, and company size

- A tailored policy can provide comprehensive protection at a competitive price

- Common misconceptions often lead to inadequate coverage

At The Allen Thomas Group, we understand the unique challenges faced by manufacturers.

With over 20 years of experience serving businesses across the US, we’re equipped to provide you with insurance solutions that fit your specific needs.

Ready to Secure Your Manufacturing Operation?

Take the first step towards comprehensive protection.

Get a Free Business Insurance Quote tailored for manufacturers today.

Our team of experts is standing by to analyze your risks and design a coverage plan that gives you peace of mind.

Call (440) 826-3676 now to schedule a consultation with one of our manufacturing insurance specialists. Don’t leave your business’s future to chance—let’s work together to build a robust safety net for your manufacturing enterprise.

Protect your assets, your employees, and your bottom line.

Contact The Allen Thomas Group today and discover how the right insurance can propel your manufacturing business forward.

Get The Right Business Insurance To Protect Your Manufacturing Company

*Note – the scenarios mentioned in this article were fictitious companies based on real organizations we cover or organization in news sources. We have changed the names to protect company information.

Author