If you own or manage a restaurant that serves alcohol, understanding the ins and outs of liquor liability is not just important—it’s essential.

This concept revolves around the legal and financial responsibilities that come with serving alcohol, especially when it involves serving minors or visibly intoxicated individuals.

The stakes are high, with potential consequences including fines, loss of liquor license, and liability for damages.

But fear not!

This article is your guide to navigating these tricky waters, emphasizing the importance of responsible service, the protection offered by liquor liability insurance, and practical steps to minimize risks.

Whether you’re looking to safeguard your business’s financial health, ensure compliance with laws, or simply foster a safer environment for your patrons, you’re in the right place.

What is Restaurant Liquor Liability?

Restaurant liquor liability refers to the legal and financial responsibility that establishments serving alcohol bear if they serve alcohol to a visibly intoxicated person or a minor who then causes harm to themselves or others.

This concept is deeply rooted in dram shop laws, which are prevalent in many jurisdictions and aim to protect the public from the risks associated with improper alcohol service.

The primary goal of these laws is to encourage responsible alcohol service and reduce alcohol-related harm by holding establishments accountable.

Restaurant owners are thus required to navigate these laws with diligence, often necessitating the training of staff in responsible service practices, verifying the ages of patrons, and monitoring alcohol consumption to mitigate risks.

Failure to adhere to these responsibilities can result in significant legal consequences, including fines, loss of liquor license, and liability for damages resulting from incidents.

Therefore, understanding and managing liquor liability is crucial for the sustainability and ethical operation of restaurants serving alcohol.

Why is Liquor Liability Important for Restaurants?

Liquor liability is crucial form of restaurant insurance because it protects against financial losses from lawsuits that can arise from alcohol-related incidents. These incidents might include serving alcohol to a visibly intoxicated patron or a minor, which can lead to accidents or harm.

By having liquor liability coverage, restaurants safeguard themselves against the potential legal and financial repercussions that could otherwise cripple their business.

Moreover, this type of insurance ensures compliance with state and federal laws.

The laws surrounding the sale and service of alcohol are stringent and vary by location, but the failure to comply can result in severe penalties, including fines and the loss of the liquor license.

Compliance helps maintain the establishment’s reputation and fosters a safer environment for patrons and the community.

In essence, liquor liability is not just about legal compliance; it’s about protecting the restaurant’s financial health, reputation, and its very ability to operate.

It is an essential aspect of risk management that restaurant owners cannot afford to overlook.

Protects against Financial Losses from Lawsuits

Liquor liability insurance acts as a critical safety net for restaurants, offering protection against the financial repercussions of lawsuits.

When alcohol is served to a minor or an already intoxicated patron, leading to an accident or injury, the establishment could find itself legally culpable. This coverage provides a financial cushion, covering the costs associated with legal defense, settlements, or judgments.

It’s an essential layer of protection that secures the restaurant’s assets and supports its operational continuity.

Ensures Compliance with State and Federal Laws

Maintaining compliance with the intricate state and federal regulations governing alcohol service is paramount for restaurants. Liquor liability insurance is more than just financial protection; it’s a testament to a restaurant’s dedication to legal compliance.

This commitment involves training staff in responsible serving practices and diligently verifying patrons’ ages.

By ensuring adherence to the law, restaurants mitigate the risk of fines, legal penalties, or the loss of a liquor license, protecting the establishment’s reputation and its capacity to serve its community.

How do Restaurants Incur Liquor Liability?

Restaurants can incur liquor liability through various actions that violate state and federal regulations on alcohol service.

Understanding these scenarios is crucial for restaurant owners and managers to mitigate risks effectively.

Serving Alcohol to Visibly Intoxicated Patrons

Serving alcohol to patrons who are clearly intoxicated not only endangers their safety but also significantly increases the restaurant’s liability. According to the National Highway Traffic Safety Administration, alcohol-impaired driving fatalities accounted for 28% of all traffic fatalities in 2019.

Case Study: In 2011, an intoxicated man left the Southside Bar & Grill in Texas and died after driving the wrong way down an interstate, colliding with a motorist, according to My San Antonio. The accident caused the amputation of the victim’s leg, among other injuries, and the bar was found 75 percent liable for the crash, paying $2.7 million in damages.

Serving Alcohol to Minors Unknowingly

Even if unintentional, serving alcohol to minors constitutes a grave violation that can lead to severe legal repercussions and financial penalties for a restaurant.

The Alcohol Policy Information System reports that all 50 states have zero tolerance laws for underage drinking and driving.

Example: A restaurant in California faced a $3,000 fine, a 15-day license suspension, and mandatory retraining of all staff after unknowingly serving alcohol to a 20-year-old customer.

The establishment also faced a civil lawsuit from the minor’s parents, underscoring the importance of rigorous age verification processes.

Allowing Disorderly Conduct on Premises

Permitting disorderly conduct within a restaurant’s confines not only detracts from the dining experience of other patrons but also heightens the establishment’s liability risks. Such conditions can lead to situations where injuries or damages occur, for which the restaurant could bear responsibility.

Real-world Incident: In 2020, a New York restaurant was held liable for $2.5 million in damages after a bar fight on their premises resulted in severe injuries to a patron.

The court found that the restaurant failed to provide adequate security measures and intervene in escalating tensions, emphasizing the importance of maintaining a safe environment.

To minimize these risks, restaurants should:

- Implement comprehensive staff training programs

- Establish clear policies and procedures for alcohol service

- Invest in reliable age verification systems

- Maintain vigilant on-premises security

- Consider obtaining robust liquor liability insurance

By understanding and addressing these common scenarios, restaurant owners can better protect their businesses from the significant legal and financial risks associated with liquor liability.

What are the Types of Liquor Liability Insurance?

Understanding the various types of liquor liability insurance is crucial for restaurant owners to ensure comprehensive protection against alcohol-related risks. Here are the primary types of coverage available:

General Liability Insurance with Liquor Coverage

This type of insurance offers a broad safety net, encompassing a wide range of incidents, including those related to alcohol service.

Coverage Comparison:

- Standard limit: Typically $1 million per occurrence and $2 million aggregate

- Extended limit: Can go up to $5 million per occurrence and $10 million aggregate

Example Claim: A restaurant in Chicago faced a $1.5 million lawsuit when a patron slipped and fell after spilling their drink. The general liability policy with liquor coverage helped cover legal fees and the settlement, demonstrating its value in protecting against unforeseen incidents.

Liquor Legal Liability Insurance

This specialized coverage is designed specifically for claims arising directly from alcohol service, offering targeted protection against common risks in the restaurant industry.

Key Differences from General Liability:

- Focused Coverage: Specifically covers alcohol-related incidents, unlike the broader general liability

- Higher Limits: Often provides higher coverage limits for alcohol-specific claims

- Legal Defense: Usually includes coverage for legal defense costs in alcohol-related lawsuits

Typical Covered Incidents:

- Serving alcohol to visibly intoxicated persons

- Alcohol-related fights or assaults on premises

- Drunk driving accidents caused by overserved patrons

Assault and Battery Coverage

This coverage addresses specific incidents such as fights or altercations on the premises, which are more likely to occur in establishments serving alcohol.

Successful Claim Example: In 2021, a Las Vegas nightclub filed a claim under their assault and battery coverage after a fight broke out between patrons, resulting in injuries and property damage.

The insurance covered:

- $150,000 in medical expenses for injured parties

- $50,000 in property damage repairs

- $100,000 in legal defense costs

This case demonstrates how assault and battery coverage can protect restaurants from significant financial losses due to violent incidents.

When selecting insurance, restaurant owners should consider:

- The specific risks associated with their establishment

- State laws and requirements for liquor liability coverage

- The claims history of their business and similar establishments in the area

- Cost-benefit analysis of higher coverage limits versus premium costs

By understanding and choosing the right combination of these insurance types, restaurant owners can create a comprehensive risk management strategy to protect their business from the unique challenges associated with serving alcohol.

How can Restaurants Minimize Liquor Liability Risks?

Restaurants can significantly reduce their liquor liability risks by implementing proactive measures and fostering a culture of responsible alcohol service.

Here are key strategies:

-

Implementing Strict Serving Policies Based on Legal Requirements

Establishing and enforcing rigorous serving policies is crucial for risk mitigation.

Effective Policy Example: The “Traffic Light System” implemented by a chain of restaurants in California has proven highly effective:

- Green: Patrons are served normally

- Yellow: Service slowed, food offered, and staff alerted to monitor closely

- Red: Service stopped, alternative transportation arranged

This system resulted in a reduction in alcohol-related incidents over two years, demonstrating how clear, actionable policies can significantly reduce liability risks.

-

Training Staff on Responsible Service and Recognizing Intoxication

Comprehensive staff training is essential for maintaining a safe environment and complying with regulations.

Effective Training Programs:

- ServSafe Alcohol: This nationally recognized program has been particularly effective in educating staff. Restaurants that have implemented ServSafe training report up to a 50% decrease in alcohol-related incidents.

- TIPS (Training for Intervention ProcedureS): This program focuses on recognizing signs of intoxication and intervention techniques. A study showed that bars and restaurants with TIPS-certified staff experienced 18% fewer drunk driving incidents in their vicinity.

-

Regularly Reviewing and Updating Policies to Comply with Laws

Staying current with changing laws and regulations is crucial for maintaining compliance and reducing liability.

Case Study: A Seattle-based restaurant group implemented a quarterly legal review process. During one such review, they identified a new local ordinance requiring additional signage about ride-sharing services.

By promptly complying, they avoided potential fines and were prepared when an alcohol enforcement check occurred two months later. This proactive approach has helped them maintain a clean record with local authorities for over five years.

-

Installing Surveillance Systems to Monitor and Record Incidents

Modern surveillance technology can play a crucial role in risk management and dispute resolution.

Surveillance Success Story: A Chicago sports bar installed a comprehensive HD camera system covering all serving areas.

Within the first year:

- They successfully defended against two false claims of overserving, saving an estimated $100,000 in potential legal fees and settlements.

- The visible presence of cameras resulted in a 30% decrease in reported altercations.

- Staff reported feeling more secure, leading to improved morale and lower turnover rates.

Additional Risk Minimization Strategies:

- Implement a designated driver program or partner with ride-sharing services

- Use age verification technology to prevent serving minors

- Offer food specials during peak drinking hours to slow alcohol absorption

- Train staff in conflict de-escalation techniques

- Maintain detailed incident logs to track patterns and adjust policies accordingly

By combining these strategies, restaurants can create a comprehensive approach to minimizing liquor liability risks.

This not only protects the business financially but also fosters a safer environment for patrons and staff, enhancing the overall dining experience and reputation of the establishment.

What are the Consequences of Not Managing Liquor Liability?

Failing to properly manage liquor liability can have severe and far-reaching consequences for restaurants. These repercussions can impact a business’s financial health, legal standing, and long-term viability. Let’s explore the major consequences:

Legal Actions and Fines from Serving Violations

Restaurants that fail to adhere to liquor laws face significant legal and financial risks.

Real-Life Scenario: In New Mexico, a bartender at a local bar served multiple drinks to a customer over several hours. The customer’s blood alcohol level reached 0.24, three times the legal limit. Later that night, this intoxicated individual got into an altercation with another patron, drew a gun, and fired several shots. One person was killed and another injured. The family of the deceased victim sued the bar and bartender for wrongful death due to overserving the assailant.

Loss of Liquor License and Business Closure

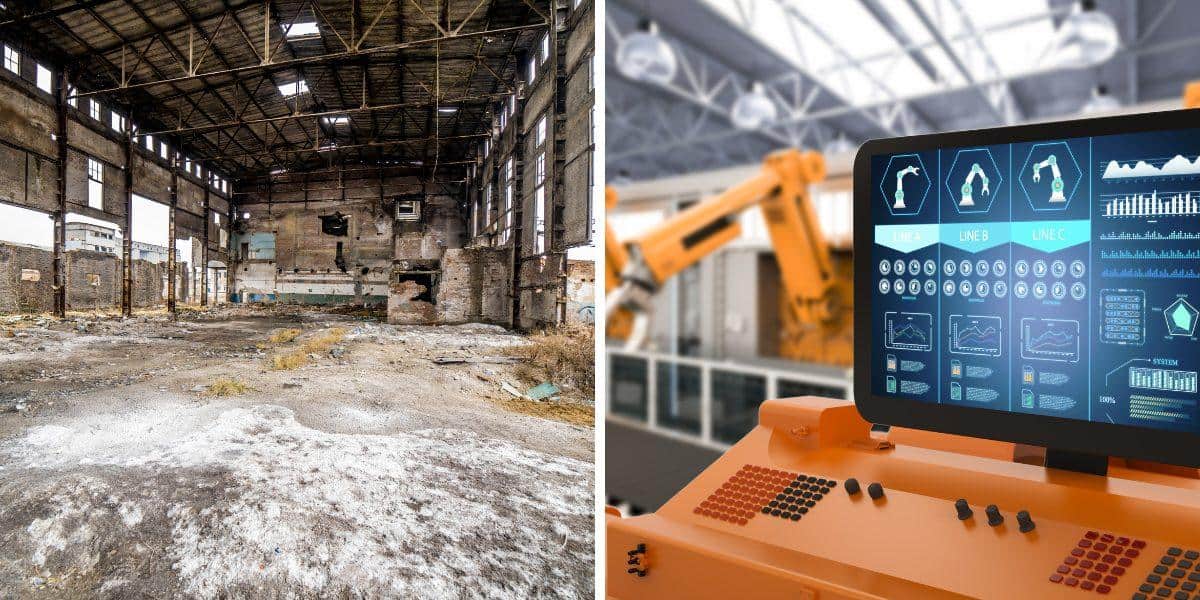

The loss of a liquor license can be devastating, often leading to business closure.

Case-Study: In 2020, a popular bar in Boston lost its liquor license after multiple violations, including serving minors and overserving patrons. Despite attempts to operate as a non-alcoholic venue, the business saw a 90% drop in revenue and was forced to close within three months, resulting in 25 job losses.

Damage to Reputation and Loss of Customer Trust

Poor liquor liability management can severely tarnish a restaurant’s reputation, leading to a loss of customer trust and patronage.

Example: A high-end steakhouse in New York faced public backlash after a patron who was overserved caused a multi-car accident.

The incident went viral on social media, leading to:

- A 60% drop in reservations over the following six months

- Negative reviews focusing on “irresponsible service practices”

- Cancellation of three major corporate accounts worth $500,000 annually

The restaurant spent over $200,000 on a PR campaign to rebuild its reputation but continued to struggle with public perception for years.

Increased Insurance Premiums or Loss of Coverage

Mismanagement of liquor liability can result in skyrocketing insurance costs or even a complete loss of coverage.

Case in Point: A chain of sports bars in California saw their annual insurance premiums increase by 150% after multiple alcohol-related incidents in one year. The increased cost, from $50,000 to $125,000 per year, forced the closure of two underperforming locations.

Additional Consequences to Consider:

- Criminal charges for owners or managers in severe cases of negligence

- Difficulty in obtaining future business loans or leases due to a tarnished record

- Loss of valuable staff due to a unsafe work environment or business instability

- Increased scrutiny from local authorities, leading to more frequent inspections and potential for further violations

The consequences of mismanaging liquor liability extend far beyond immediate financial penalties. They can threaten the very existence of a restaurant and have long-lasting impacts on owners, employees, and the community.

Proactive Management is Key:

- Regularly train staff on responsible alcohol service

- Implement and strictly enforce clear policies on alcohol service

- Stay informed about local liquor laws and regulations

- Invest in comprehensive liquor liability insurance

- Foster a culture of responsibility and safety in your establishment

By prioritizing effective liquor liability management, restaurants can avoid these severe consequences and create a safer, more sustainable business environment for all stakeholders.

Protect Your Restaurant’s Future with Proper Liquor Liability Management

As we’ve explored throughout this article, understanding and managing liquor liability is crucial for the success and longevity of your restaurant.

From implementing strict serving policies to choosing the right insurance coverage, every step you take to mitigate risks protects not just your business, but also your patrons and community.

Remember:

- Proper training and policies can significantly reduce incidents

- The right insurance coverage is your financial safety net

- Proactive management helps maintain your reputation and customer trust

Don’t let the consequences of mismanaged liquor liability jeopardize the business you’ve worked so hard to build. At The Allen Thomas Group, we understand the unique challenges faced by restaurant owners when it comes to liquor liability.

Take the Next Step to Safeguard Your Restaurant

Ready to ensure your restaurant has the protection it needs? We’re here to help.

Get Your Free Restaurant Business Insurance Quote Today!

Our experts will tailor a liquor liability insurance plan that fits your specific needs and budget.

Don’t wait for an incident to occur – be proactive in protecting your business.

Call (440) 826-3676 now to schedule a consultation with our experienced team.

Let our commercial insurance agents help you serve your customers with confidence, knowing you’re properly protected against liquor liability risks.

Secure your restaurant’s future today – because your peace of mind is our top priority.

Get The Right Business Insurance To Protect Your Restaurant Now

Author